Individual Taxpayer Identification Number (ITIN)

Streamline Your ITIN Application with Expert Assistance

At WiseChoice Tax Solutions, we specialize in providing Individual Taxpayer Identification Number (ITIN) services as a Certified Acceptance Agent (CAA). Whether you’re an individual, business owner, or foreign national needing to comply with U.S. tax requirements, our team is here to make the process seamless and stress-free.

An ITIN is a tax-processing number issued by the Internal Revenue Service (IRS) for individuals who are not eligible to obtain a Social Security Number (SSN). ITINs are crucial for:

- Filing U.S. tax returns.

- Claiming tax treaty benefits.

- Opening financial accounts.

- Complying with U.S. tax obligations.

Applying for an ITIN can be complex, but as a Certified Acceptance Agent, we are authorized by the IRS to:

- Review your documents.

- Certify your identity without requiring you to send original documents to the IRS.

- Opening financial accounts.

- Submit your ITIN application directly to the IRS on your behalf.

You may need an ITIN if you:

- Are a non-resident alien filing a U.S. tax return.

- Are a dependent or spouse of a U.S. citizen or resident alien.

- Are a foreign national with U.S. income or investments.

- Are an individual needing to comply with U.S. tax requirements but ineligible for an SSN.

We provide end-to-end support for ITIN applications, including:

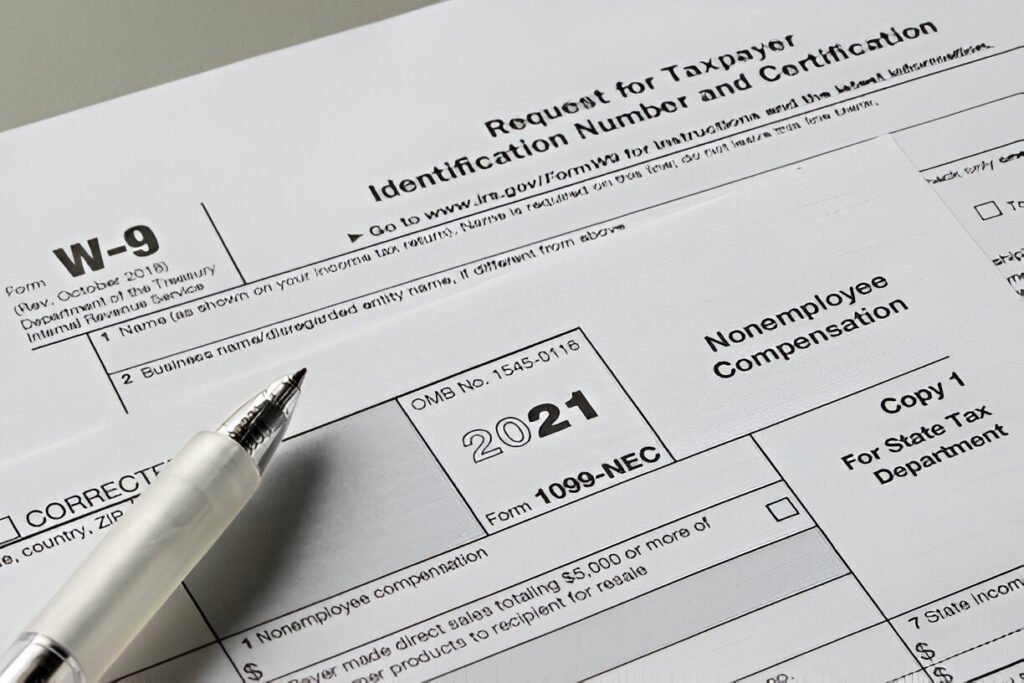

- Initial Applications: Guidance through the W-7 form and documentation requirements.

- Renewals: Assistance for individuals whose ITINs have expired.

- Corrections: Help resolving issues with existing ITINs.

- Dependents: Supporting spouses and dependents in obtaining their ITINs.

To apply for an ITIN, you’ll need:

- A completed IRS Form W-7.

- Valid identification documents (passport, national ID, etc.).

- Supporting documents to justify your ITIN application (e.g., a U.S. tax return or other IRS-required forms).

- Expert Guidance: Years of experience in ITIN applications and tax compliance.

- Time-Saving Convenience: Avoid mailing sensitive original documents.

- Personalized Support: Tailored advice to suit your specific tax situation.

- Trusted Partner: Certified by the IRS to simplify your ITIN process.

Get Started Today

Don’t let the ITIN application process overwhelm you. Let WiseChoice Tax Solutions, handle the details while you focus on what matters most.

Contact us today to schedule a consultation and simplify your ITIN journey.